Table of Contents

ToggleBuying a home can feel like preparing for a first date—exciting yet nerve-wracking. One minute you’re daydreaming about cozy nights by the fireplace, and the next, you’re drowning in paperwork and mortgage jargon. Fear not! A home buying checklist is your trusty sidekick, guiding you through the maze of property hunting with the finesse of a seasoned pro.

This handy list isn’t just a collection of tasks; it’s your roadmap to homeownership bliss. From budgeting for that dream kitchen to finding the perfect neighborhood, having a checklist keeps you organized and sane. So, buckle up and get ready to navigate the real estate rollercoaster with confidence and a sprinkle of humor. After all, who said buying a house can’t be fun?

Importance Of A Home Buying Checklist

A home buying checklist simplifies the complex process of purchasing real estate. It serves as an essential tool for prospective homeowners to stay organized throughout the journey. By outlining key tasks, the checklist enhances focus and reduces the likelihood of overlooking crucial items.

Managing finances becomes more efficient with a checklist. It includes steps like determining a budget, securing financing options, and calculating additional expenses. Accurate financial planning allows buyers to find properties within their means.

Selecting the right neighborhood is another critical aspect covered. Prioritizing factors such as schools, amenities, and commute times ensures that buyers choose locations fitting their lifestyle. Information collected helps compare neighborhoods effectively.

Conducting thorough research proves vital. The checklist prompts buyers to evaluate property listings, schedule viewings, and analyze neighborhood trends. Gathering data empowers informed decisions during the buying process.

Negotiating offers and understanding contracts also gain clarity from using a checklist. It highlights essential terms to review, increasing confidence during negotiations. Familiarity with the paperwork streamlines communication with real estate agents and lawyers.

Being prepared for closing is equally important. The checklist reminds buyers to gather necessary documents, conduct final inspections, and secure appropriate insurance. Comprehensive preparation helps minimize stress on closing day.

A well-structured home buying checklist fosters a systematic approach. Each item serves a purpose, guiding homeowners from initial planning to final purchase. Using this tool enhances the entire home buying experience while instilling a sense of confidence.

Preparing For The Home Buying Process

The home buying process involves careful preparation. Prospective homeowners must follow practical steps to ensure a smooth experience.

Setting A Budget

Establishing a budget forms the foundation of the home buying journey. Buyers should calculate their monthly income and expenses to determine how much they can allocate to housing costs. Lenders typically suggest that mortgage payments shouldn’t exceed 28% of gross monthly income. Consider additional expenses like property taxes, homeowners insurance, and maintenance. Setting aside funds for a down payment is crucial. Buyers are encouraged to aim for at least 20% of the home’s price to avoid private mortgage insurance. Gathering documentation for pre-approval strengthens the financing position.

Identifying Your Needs

Understanding personal needs simplifies the house-hunting process. Buyers must prioritize essential features, such as the number of bedrooms, bathrooms, and outdoor space. Neighborhood characteristics, such as proximity to schools and public transportation, also weigh heavily in decision-making. Buyers should consider lifestyle aspects like commutes, entertainment, and nearby amenities. Listing non-negotiable versus desirable features can help streamline options. Compiling this information can clarify expectations and make it easier to communicate with real estate agents. Prioritizing these factors aids in finding the right home.

Steps To Create An Effective Home Buying Checklist

Creating a comprehensive home buying checklist involves several key steps that streamline the purchasing process.

Researching Neighborhoods

Research plays a crucial role in finding the right home. Start by evaluating the local amenities, including schools, parks, and shopping centers. Consider crime rates as well, as safety influences many buyers. Access to public transportation can affect daily commutes. Analyze neighborhood trends, such as property value fluctuations over time. Property listings and online reviews provide insights into the community atmosphere. Finally, visit the neighborhoods at various times to gauge livability.

Inspecting Properties

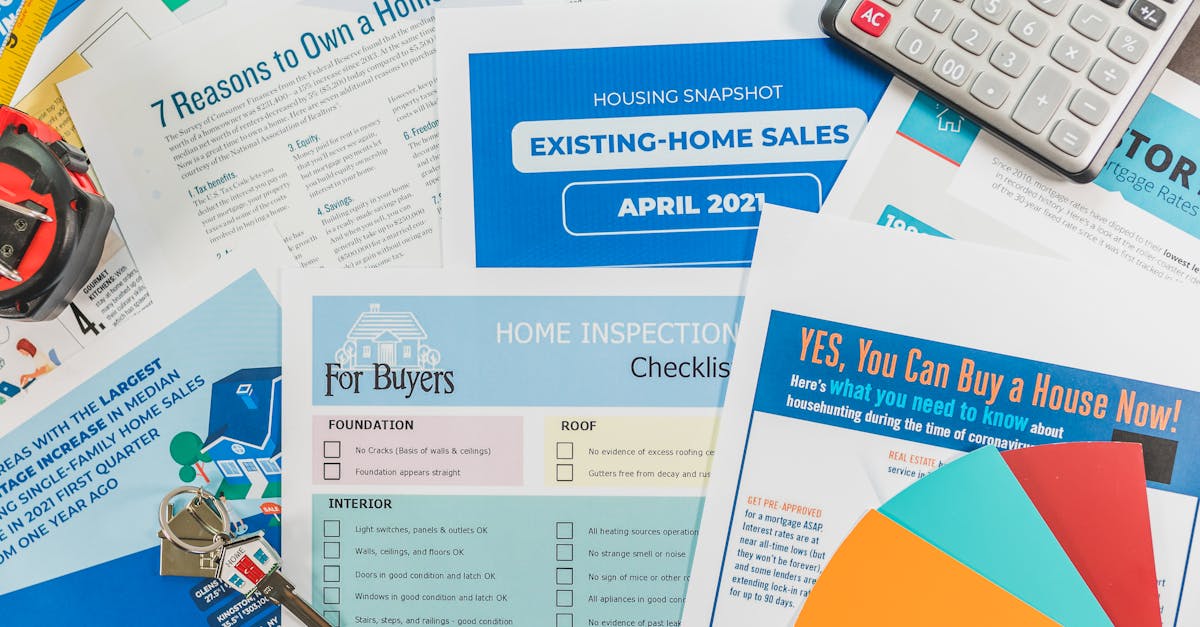

Inspecting properties thoroughly prevents future regrets. Schedule visits to multiple homes to compare features and conditions. Check for structural issues, such as roof and foundation problems. Pay attention to plumbing and electrical systems for potential repairs. Evaluate the overall layout to ensure it meets personal needs, including room sizes and flow. Bring a trusted friend or family member for a second opinion. Utilize a checklist during inspections to track observations and take notes.

Understanding Financing Options

Understanding financing options simplifies the buying process. Start with pre-approval from a lender to grasp the budget. Explore different loan types, such as fixed-rate or adjustable-rate mortgages. Factor in interest rates and their impact on monthly payments. Understand additional costs, including closing costs and property taxes. Research government programs that assist first-time buyers. Compile necessary documentation, such as credit scores and income verification, to expedite the process.

Utilizing The Home Buying Checklist

The home buying checklist serves as a critical tool in the property purchasing process. With it, buyers can efficiently track tasks and ensure no steps are overlooked. Maximizing financial management is essential; maintaining mortgage payments below 28% of gross monthly income plays a significant role in affordability. Establishing a down payment of at least 20% prevents private mortgage insurance, providing financial relief.

Identifying personal needs simplifies home searches. Buyers prioritize essential features such as the number of bedrooms and location’s amenities. Differentiating between non-negotiable and desirable aspects helps clarify expectations and fosters effective communication with real estate agents.

Researching neighborhoods lays the groundwork for a successful purchase. Evaluating local safety, school districts, and property trends enhances community selection. Thorough property inspections prevent future regrets, so it’s vital to check for structural issues and utilize checklist items during visits.

Understanding financing options leads to informed decisions. Obtaining pre-approval streamlines the process and demonstrates serious intent to sellers. Exploring various loan types exposes buyers to the most suitable choices. Awareness of additional costs, such as closing fees and inspections, further informs budgeting decisions.

Being organized on closing day is crucial. Buyers must gather necessary documents and prepare for final inspections, ensuring a smooth transition into homeownership. Following the home buying checklist promotes a logical approach and enables prospective homeowners to navigate this exciting journey with confidence and clarity.

Common Mistakes To Avoid

Not prioritizing a budget often leads to overspending during home purchases. Spending more than 28% of monthly income on mortgage payments limits financial flexibility and can cause future strain.

Neglecting to thoroughly research neighborhoods may result in choosing a less favorable location. Evaluating aspects like schools, safety, and amenities ensures long-term satisfaction with the investment.

Skipping property inspections can lead to unexpected repair costs. Inspections uncover potential issues such as structural problems and necessary maintenance, protecting buyers from costly surprises.

Overlooking financing options may restrict available resources. Obtaining pre-approval and exploring various loan types helps buyers understand their financing capacity and associated costs.

Failing to communicate with the real estate agent can create misunderstandings. Clearly expressing non-negotiable and desirable features streamlines the search process and fosters better collaboration.

Disregarding necessary documents on closing day can result in delays. Preparing all required paperwork ahead of time ensures a smoother transition into homeownership.

Avoiding negotiations can lead to missed opportunities for savings. Engaging in open conversations about price and terms helps buyers advocate for their interests effectively.

Making hasty decisions without exploring multiple properties often results in regret. Exploring various listings allows buyers to compare options and make informed choices based on preferences and needs.

By steering clear of these common pitfalls, buyers enhance their overall experience and navigate the complexities of home buying with confidence.

Conclusion

Navigating the home buying journey can be daunting but with a well-crafted checklist, it becomes manageable and enjoyable. This tool not only keeps buyers organized but also empowers them to make informed decisions throughout the process. By focusing on budgeting, neighborhood research, and thorough inspections, prospective homeowners can avoid common pitfalls and enhance their overall experience.

Embracing the excitement of finding a new home while staying grounded in practical steps will lead to a successful purchase. With the right preparation and mindset, buyers can approach closing day with confidence, knowing they’ve taken the necessary steps to secure their dream home.